Filter By Year : Latest | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | All

Quarterly Report For The Financial Period Ended 31 December 2014

Quarterly Report For The Financial Period Ended 30 September 2014

Quarterly Report For The Financial Period Ended 30 June 2014

Quarterly Report For The Financial Period Ended 31 March 2014

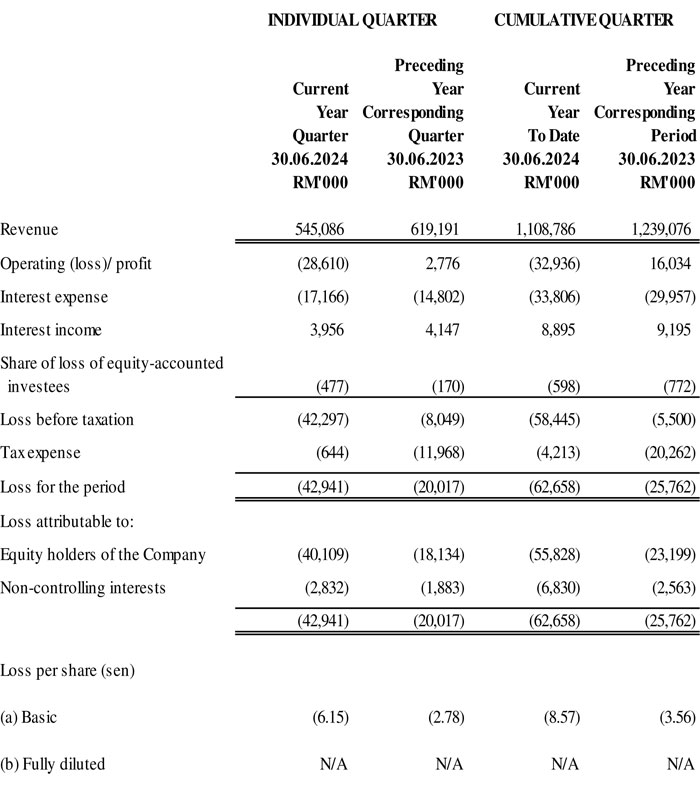

Condensed Consolidated Statement Of Profit Or Loss For The Quarter Ended 30 June 2024

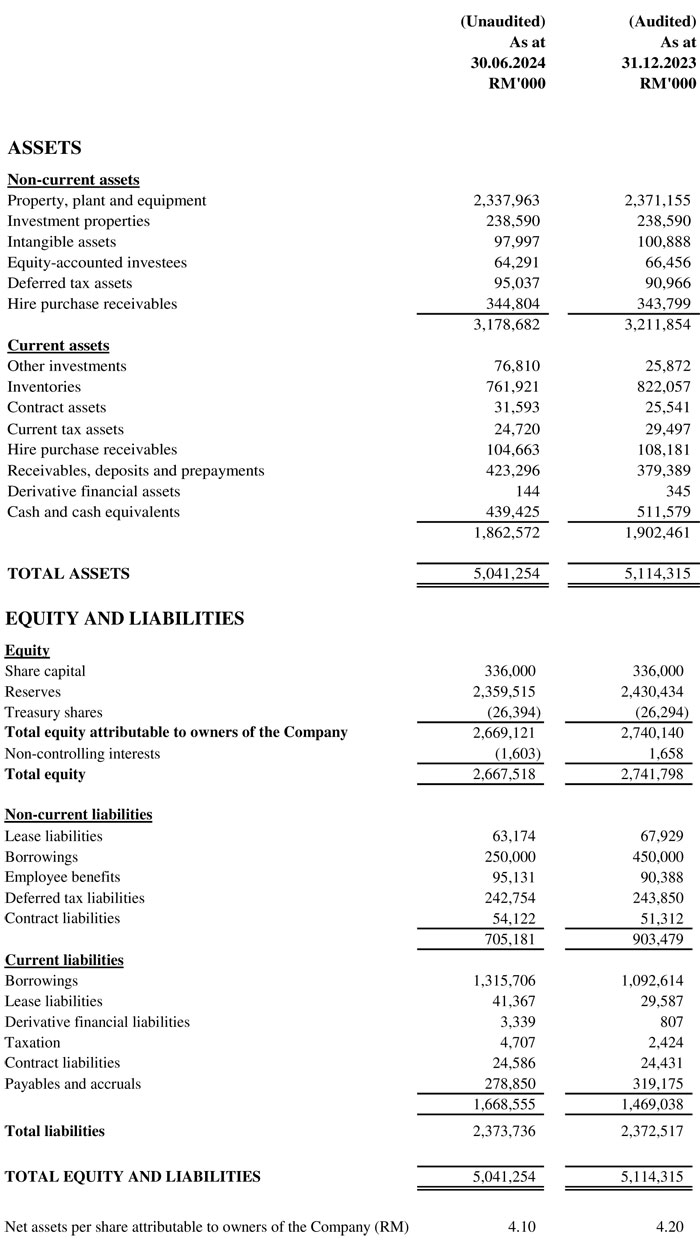

Condensed Consolidated Statement Of Financial Position As At 30 June 2024

Analysis Of Performance Of All Operating Segments

For the quarter ended 30 June 2024, the Group recorded revenue of RM545.1 million, a reduction of 12.0% compared to the same period preceding year, mainly due to softer consumer sentiments and a highly competitive business landscape in the local and overseas markets. In line with the lower revenue and lower margin, the Group recorded a Loss Before Tax ("LBT") of RM42.3 million in the current quarter under review, compared to LBT of RM8.0 million in the same period preceding year.

For the six months ended 30 June 2024, the Group recorded revenue of RM1.1 billion, 10.5% lower than in the same period preceding year. As a result, the Group recorded a LBT of RM58.4 million in the current year-to-date period, compared to LBT of RM5.5 million in the same period last year. The decrease in profitability was mainly due to lower sales and lower net foreign exchange gain.

As of 30 June 2024, the Group’s retained earnings were RM1.47 billion. The net assets per share as of 30 June 2024 was lower at RM4.10, compared to RM4.20 as of 31 December 2023. Further analysis of the performance of the business segments is as follows:

- Vehicles Assembly, Manufacturing, Distribution & After-Sales Services ("Automotive")

The automotive division recorded lower revenue of RM521.1 million in the current quarter under review, a reduction of 12.5% compared to the same period preceding year ("YoY"). The decrease in sales was mainly due to stiffer competition in local and overseas markets. Earnings Before Interest, Tax, Depreciation and Amortisation ("EBITDA") of RM0.5 million varied by -97.1% YoY, mainly due to lower revenue and lower margin arising from weaker Ringgit during the current quarter under review.

For the six month period ended 30 June 2024, the automotive division recorded revenue of RM1,059.5 million (-11.3% YoY) and EBITDA of RM5.8 million (-90.5% YoY), mainly due to lower revenue, lower margin arising from weaker Ringgit, and lower net foreign exchange gain.

-

Financial Services (Hire Purchase and Insurance)

The financial services division recorded revenue of RM16.8 million in the current quarter under review (+5.9% YoY) and EBITDA of RM2.5 million (-40.6% YoY). EBITDA was lower mainly due to higher impairment loss on hire purchase receivables in the current quarter under review compared to the same period preceding year.

For the six months ended 30 June 2024, the financial services division recorded higher revenue of RM35.5 million (+6.6% YoY) with lower EBITDA of RM6.8 million (-37.2% YoY). EBITDA was lower for the same reason explained in the paragraph above.

-

Other Operations (Investments and Properties)

Revenue from Other Operations was lower at RM7.2 million in the current quarter under review (-7.8% YoY) and recorded a lower EBITDA of RM6.3 million in the current quarter compared to EBITDA of RM33.4 million in the same period preceding year (-81.3% YoY), mainly due to lower net foreign exchange gain in current quarter compared to same period preceding year which arose from transactions and outstanding balances denominated in foreign currencies.

For the six months ended 30 June 2024, revenue from Other Operations was higher at RM13.8 million (+23.8% YoY) and EBITDA of RM28.8 million was lower by 18.1% YoY. Revenue was higher mainly due to higher revenue recognised in the solar energy division in the current year-to-date period. The decrease in EBITDA was primarily due to lower net foreign exchange gain in the current year-to-date period, which arose from transactions and outstanding balances denominated in foreign currencies.

Future Prospects

The global economy experienced moderate growth in the first half of 2024, with Gross Domestic Product ("GDP") expanding at a rate of approximately 2.5% to 3.0% despite challenges from economic uncertainties across the globe. Regional economies such as Vietnam, Thailand and Indonesia as well as Malaysia are showing signs of steady recovery, driven by resilient domestic demand, rebound in tourism, and strong export activities. On the domestic front, the Government is optimistic that the full year 2024 GDP is well placed to expand by 4.0% to 5.0% after a relatively strong GDP growth of 5.9% in Quarter 2 of 2024. Total industry volume ("TIV") in the first six months of 2024 grew by 6.6% compared to the same period in 2023, mainly driven by the national car makes and the new entrants of Chinese marques. Malaysian Automotive Association has however forecasted the full year 2024’s TIV to shrink by 4% to 765,000 units compared to the historic high of 799,731 units in 2023.

We will continue to enhance our existing showrooms and service centres in the domestic market to elevate customers’ experience with our products and services. With the impending launch of the e-powered model towards the end of 2024 and a few other new models in the pipeline over the next 24 months, we expect the Nissan segment to regain some of its lost ground moving forward.

Meanwhile in Vietnam, we expect the Euro 5 King Long buses and TQ Wuling N300P light commercial pick-ups to continue their sales momentum and drive better plant utilisation. With the newly launched GAC completely-built-up ("CBU") models M8 and GS8, we are cautiously optimistic that the performance in Vietnam will start to show some improvements in the months ahead.

Moving forward, the Group has an extensive line-up of business initiatives and pipeline of new models for both its passenger and commercial vehicles as the catalysts to drive better performance. There are also additional contract assembly activities that will materialise over the course of next few quarters and is expected to generate improved financial performance for the Group. In addition, the Group will continue to rationalise its operations to drive down the cost of doing business and focus on prudent management of its resources to navigate through the challenging times ahead and deliver long term operational and financial sustainability.